One of the values we hold dear is Do "the right things in the right way.” We are working to strengthen our corporate governance to improve the transparency and soundness of management and to increase the speed and quality of management decision-making, with the aim of enhancing corporate value and making a sustainable contribution to the society.

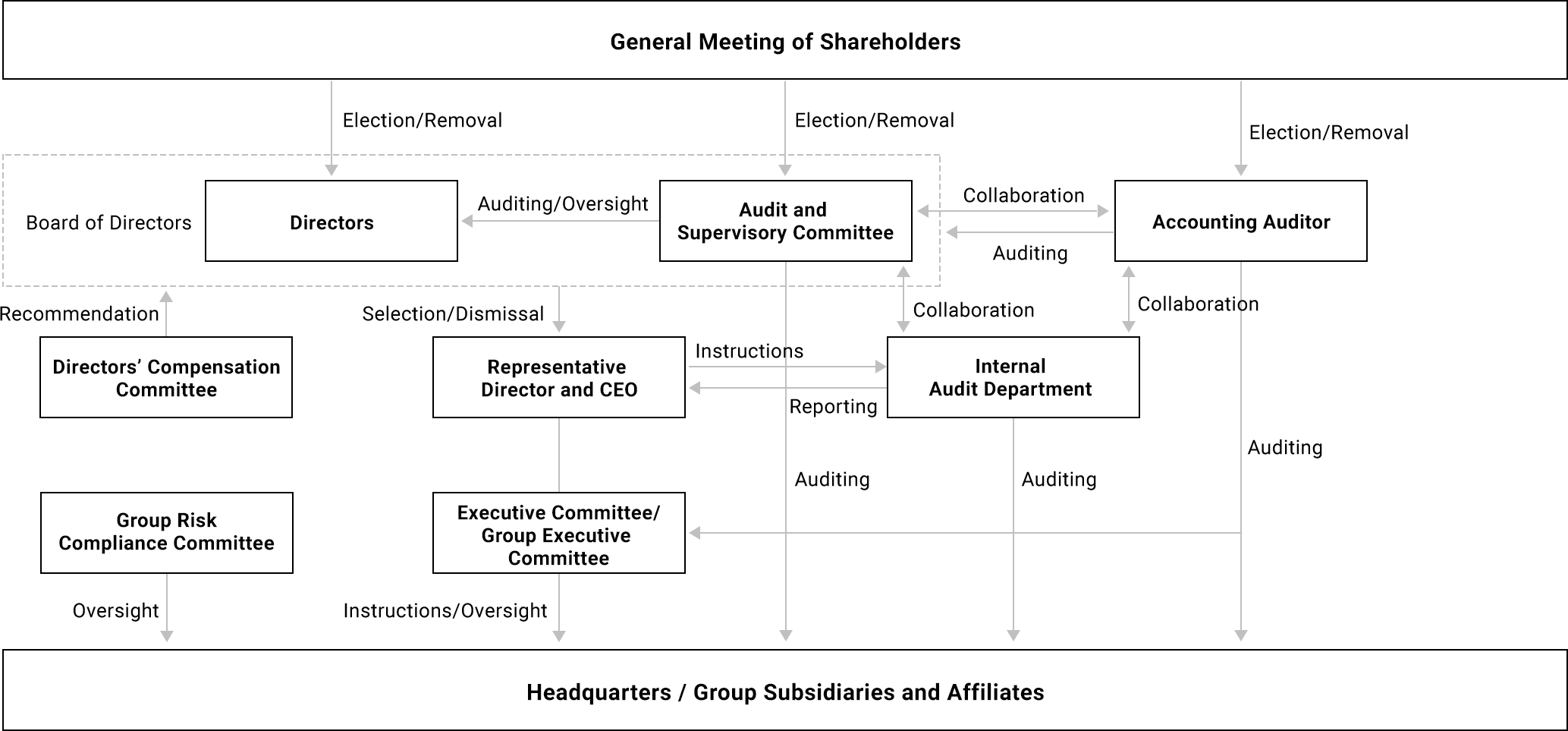

We have adopted an Audit and Supervisory Committee structure for our corporate governance scheme.

The corporate governance structure is as follows

Board of Directors

Board of Directors’ meetings are held monthly, in principle, to make decisions on the Group’s management policies, management plans, annual budgets, and other important matters of each Group company. The Board of Directors also oversees business execution through examining reports on monthly budget control, monthly business performance, and other important business matters from each Group company.

For profiles of our directors and diverse management team, please click here.

Female Ratio

42.8% (3 persons)

Average Age

47.4 years old

Independence*

42.8%

*Independence is expressed as a percentage of the number of independent directors out of the number of directors of the Company as of October 22, 2025.

(As of October 22, 2025)

Audit and Supervisory Committee

Audit and Supervisory Committee meetings are held monthly, in principle, to discuss matters stipulated by laws and regulations and the Articles of Incorporation, as well as matters regarding important audit operations. In addition to attending Board of Directors’ meetings, Audit and Supervisory Committee Members also attend important management meetings to audit and supervise the status of business execution by Directors. Furthermore, the committee works closely with the accounting auditor and the Internal Audit Department to conduct necessary audits on the status of internal control, compliance, etc.

The Audit and Supervisory Committee has three members, all of whom are independent outside directors. (As of October 22, 2025)

Directors’ Compensation Committee

The Company has established the Directors’ Executive Compensation Committee as a voluntary committee for the purpose of determining compensation, etc. of Directors (excluding Directors who are members of the Audit Committee). The Directors’ Compensation Committee consists of the Representative Director and three independent outside directors. (As of October 22, 2025)

Compensation for Directors

Process for determining compensation

Individual compensation for the fiscal year ending July 31, 2025 for directors (excluding directors who are members of the Audit Committee) was determined by the Board of Directors within the total amount of compensation determined at the General Meeting of Shareholders, based on the report from the Directors’ Compensation Committee.

Individual director compensation for the fiscal year ending July 31, 2025 for directors who are members of the Audit and Supervisory Committee was determined through discussions among the directors who are members of the Audit and Supervisory Committee within the total amount of director compensation determined at the General Meeting of Shareholders.

There are no Directors whose total compensation exceeds 100 million yen or more.

Executive Compensation for the Year Ended July 31, 2025

|

|||||||||||||||||||||||||||

(Note) The number of Directors (excluding Audit and Supervisory Committee Members) includes one Director who retired at the conclusion of the 5th Annual General Meeting of Shareholders held on October 30, 2024.

Financial audit

Deloitte Touche Tohmatsu LLC has been appointed as our Financial Auditor.

Audit fees are as follows with the consent of the Audit and Supervisory Committee.

Fees paid to certified public accountants etc. and for member firms of certified public accountants etc.

|

||||||||||||||||||||||||

(Note) Non-audit fees for the period ending July 2024 relate to financial due diligence services.

Corporate Governance Report

-

Corporate Governance Report

(507KB)

Corporate Governance Report

(507KB)

Compliance and Risk Management

The Visional Group has formulated the "Visional Group Code of Conduct" as a basic code of conduct for those engaged in the Group's business operations to comply with laws, regulations, social norms, and other rules performing to their duties, and to practice sound and appropriate management and business execution.

Structure and audit mechanism

The Board of Directors of the Company is the decision-making body for important matters related to the promotion of compliance in the Group. In addition, the Group Risk Compliance Meeting, held once a quarter, formulates the Group Compliance Plan, promotes risk management and compliance measures, and shares the progress of these measures. The members of the Group Risk Compliance Meeting are the Company's directors (excluding outside directors), representative directors of the Company's group companies, and executive officer with the participation of one Audit and Supervisory Committee member and the Head of the Internal Audit Department as observers, and the Governance Department together with the Legal Department as secretariats.

In addition, an internal reporting system including whistleblowing mechanisms that can be used to report suspected cases of misconduct anonymously, if required, is in place and is in operation to ensure early detection and early correction of violations of laws and regulations, as well as to appropriately protect those who report violations of laws and regulations.

Compliance Promotion Efforts

Corruption Prevention

In the "Visional Group Code of Conduct," we have established guidelines for "elimination of antisocial forces," "elimination of unfair transactions," "prohibition of insider trading," "prohibition of bribery," etc., to ensure thorough compliance and prevention of corruption.

Internal Audit

The Internal Audit Department, which reports directly to the Representative Director, is responsible for the internal audit to ensure that the operations of each company are conducted in accordance with the internal rules and regulations established by each company, that business operations are conducted efficiently, and that compliance is observed. Each business unit that is audited is given suggestions on how to improve its operations, etc., and the status of improvement is monitored and confirmed at a later date.

Compliance Training

To establish corporate ethics and ensure compliance, we conduct various internal training programs for directors and employees of group companies to raise awareness of compliance among directors and employees and educate them on how to behave in a proper manner.

Internal Control - Basic Policy and Structure

The information is included in IV Matters Related to the Internal Control Systems in the Corporate Governance Report.